Overview

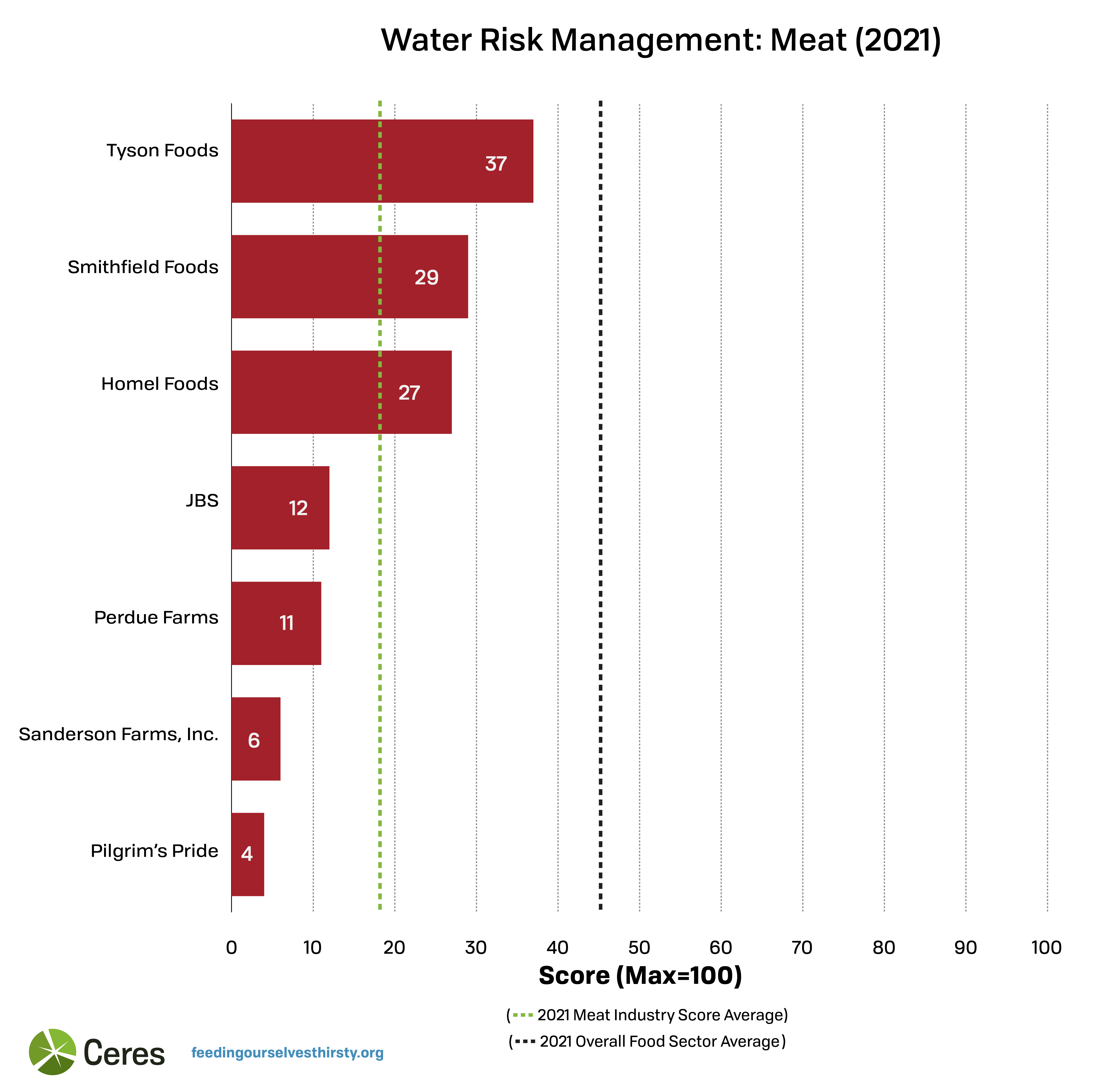

The Meat industry faces severe physical, regulatory, and reputational risks stemming from water scarcity and water pollution. Effluent from processing facilities and poor manure management from confined animal feeding operations (CAFOs) discharge harmful pollutants into waterways. Runoff from fertilizer used to grow animal feed is also a major driver of harmful algae blooms in regions like the Gulf of Mexico, Lake Erie, and Chesapeake Bay. Despite its significant exposure to water risks, the Meat sector is doing the least to manage these risks. The industry average score, 18 points out of 100, was the poorest among the four industries, consistent with prior years. The highest company score was Tyson Foods, with 37 points. Four companies, JBS, Perdue Farms, Sanderson Farms, and Pilgrim’s Pride, were bottom 10 performers, with scores ranging from 4 to 12 points.

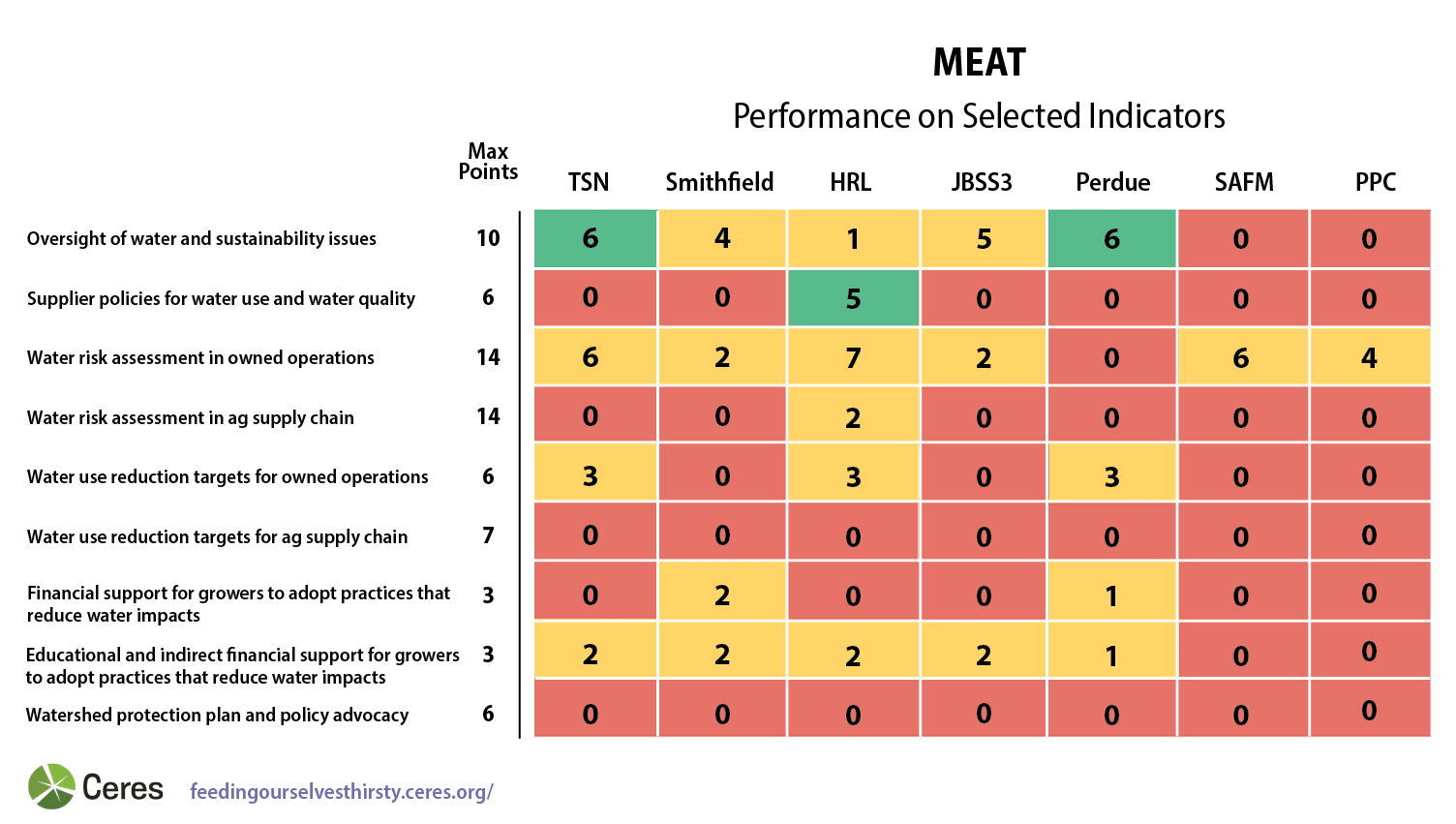

Only a selection of indicators are represented. See the scoring guidance here.

Areas of Strength

Water Risk Assessments in owned operations

Five of the seven companies analyzed have performed water quality risk assessments in their direct operations, but only one company, Tyson Foods, received partial credit for disclosing priority facilities based on its evaluation of water availability and water quality in its owned operations.

Education/Financial Incentives

Five companies have educational programs and indirect incentives for producers to promote positive water outcomes, with Tyson Foods, JBS, and Perdue Farms all improving their scores in this area compared to 2019. However, Smithfield Foods was the only company with initiatives that applied to more than 50% of suppliers.

Areas for Improvement

Despite the significant negative impacts of their vast supply chains on water scarcity and pollution – with climate-influenced extreme flooding and drought worsening these impacts – the Meat sector has shown a broad unwillingness to tackle these issues, from the board and senior management levels, to risk assessments across their value chains, to on-the-ground practices of their suppliers.

Governance

Given the large water footprint of Meat companies, stronger governance structures that promote water stewardship are an important area for improvement in the future.

Five companies have established board oversight over sustainability issues, but direct responsibility for water issues at the senior executive level is a rarity. JBS is the only company that has disclosed a regular reporting to the board on water-related issues. JBS has also appointed its CEO to report to the board on water-related issues, but only for its Brazil operations.

Only one company, Hormel Foods, has established a supplier policy with water-related expectations. The policy includes several water-related guidelines and it lists expectations for suppliers to address water quality and quantity issues while constantly improving water management.

Risk Assessment/Agricultural Supply Chain Targets

The dearth of water goals for agricultural supply chains highlights broadly weak risk assessment practices beyond the industry’s direct operations. None of the companies disclosed the location of high risk water regions based on water quality or water availability. None of the companies have developed water use targets for their supply chains or differentiated targets for high risk watersheds. Lastly, none of the companies received points for setting time-bound commitments for tackling wastewater discharges in their owned operations.

Hormel Foods was the only company that has implemented a risk assessment process, including water quality, that applies to its top suppliers.

Smithfield Foods has set several climate and water-related targets to achieve by 2030, including a target to source at least 75% of grain with more efficient soil health practices.

Collective Watershed Action

None of the companies have taken part in collaborative initiatives aimed at improving the conditions of high-stressed watersheds. There have been some isolated examples, but the water basins in these cases were not specifically defined as high risk.

Scoring Guidance for Selected Indicators

| Oversight of water and sustainability issues (Total possible score = 10 points) | |

| 2 points |

Board or board committee has oversight over sustainability ( +1 point) OR Board or board committee has explicit oversight over water-related issues (+ 2 points) |

| 3 point | Board or board committee is regularly briefed by management on water related issues |

| 4 points |

The individual with the highest level of direct responsibility for water-related issues reports directly to a member of the Executive Management Committee (+ 3 points) OR The individual with the highest level of direct responsibility for water-related issues reports to the CEO (+ 4 points) |

| 1 points | Water is linked to pay or incentive compensation for senior executives implicitly or explicitly |

| Supplier policies for water use and water quality (Total possible score = 6 points) | |

| 3 points | Has a publicly available supplier policy outlining expectations for Tier 1 suppliers regarding water use and water quality that exceed regulatory compliance |

| 1 points | The policy has a clear requirement for agricultural suppliers to have a water use plan in high risk regions |

| 1 points | The policy has clear requirements for agricultural suppliers regarding water quality that exceed regulatory compliance in high risk regions |

| 1 points | The policy clearly defines protocols for non-compliance |

| Water risk assessment in owned operations (Total possible score = 14 points) | |

| 3 points | Discloses the percentage and volume of total water withdrawal from regions with high baseline water stress |

| 3 points | Discloses the percentage and volume of total water consumed from regions with high baseline water stress |

| 4 points | Analysis explicitly included risks associated with water quality |

| 4 points |

Analysis explicitly discloses high risk watersheds based on water quality (+ 2 points) AND/OR based on water availability (+ 2 points) |

| Water risk assessment in ag supply chain (Total possible score = 14 points) | |

| 6 points | Discloses the percentage of agricultural products sourced from regions with high baseline water stress |

| 4 points | Analysis explicitly included risks associated with water quality |

| 4 points |

Analysis explicitly discloses high risk watersheds based on water quality (+ 2 points) AND/OR based on water availability (+ 2 points) |

| Water use reduction targets for owned operations (Total possible score = 6 points) | |

| 3 points | Has time-bound water use reduction targets for direct operations |

| 3 points | Uses a risk-differentiated, context-based, or science-based approach, focusing on watersheds with high water stress |

| 3 points | Has targets to reduce water pollution impacts of its operational discharge, focusing on pollutants of concern |

| Water use reduction targets for ag supply chain (Total possible score = 7 points) | |

| 4 points | Has time-bound water use reduction targets for agricultural regions/commodities |

| 3 points | Uses a risk-differentiated, context-based approach, focusing on watersheds with high water stress |

| Financial support for growers to adopt practices that reduce water impacts (Total possible score = 3 points) | |

| 2 points | Provides financial incentives to producers to encourage adoption of practices that reduce impacts and dependence on water |

| 1 points | Identified in high-risk watershed specifically |

| Educational and indirect financial support for growers to adopt practices that reduce water impacts (Total possible score = 3 points) | |

| 2 points | Provides education or indirect financial incentives to producers to encourage adoption of practices that reduce impacts and dependence on water |

| 1 points | Identified in high-risk watershed specifically |

| Watershed protection plan and policy advocacy (Total possible score = 6 points) | |

| 4 points | Has developed a watershed protection plan or strategy for key watersheds identified as high risk in their agricultural supply chain which includes plans to support projects that improve conditions for the watershed in collaboration with key local stakeholders |

| 2 points | Consistently advocates for public policy action to protect water resources in company's priority watersheds |

Scores are based on companies' public disclosures as of June 15, 2021.