Overview

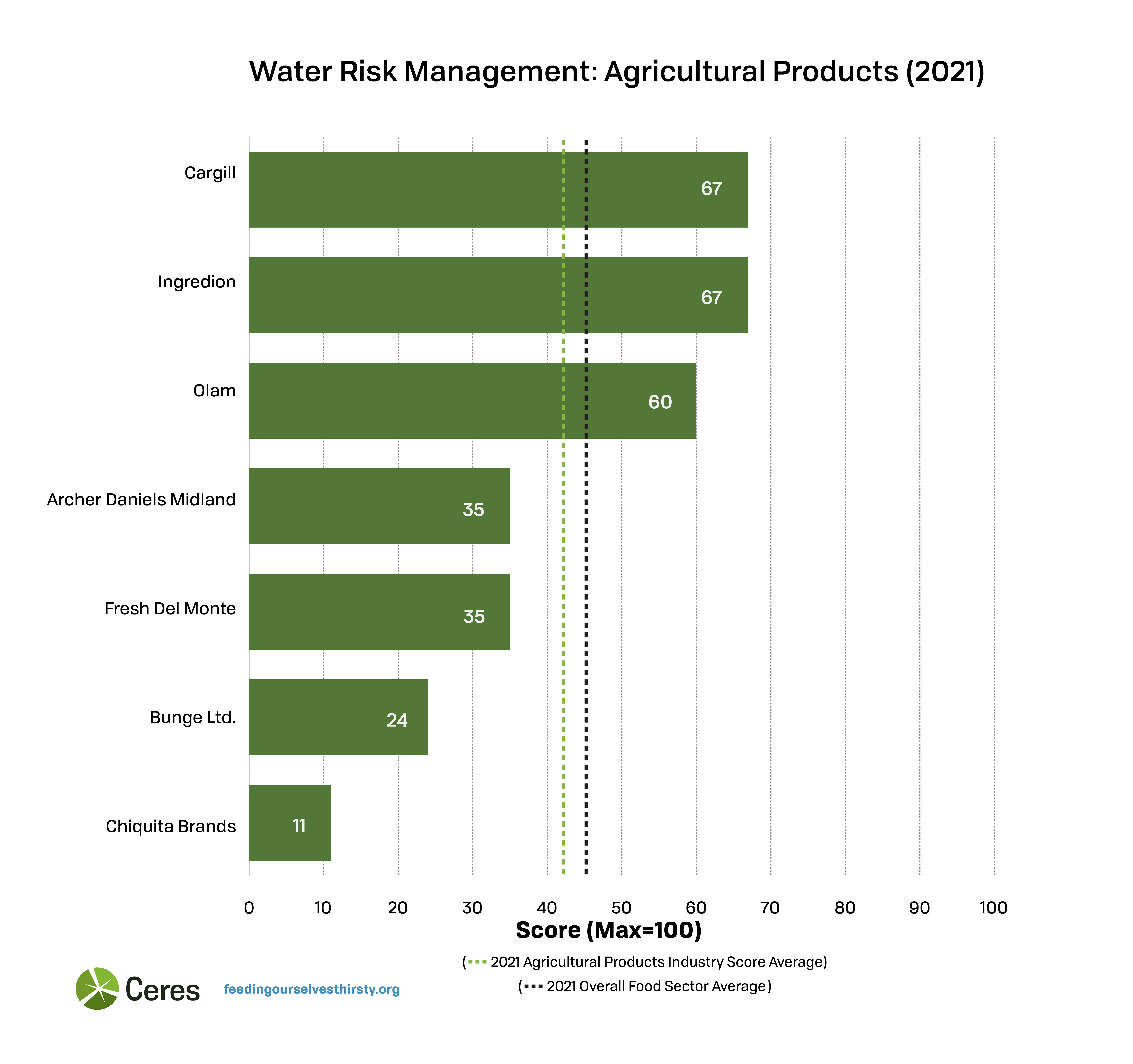

While the Agricultural Products sector has made substantial improvements in particular areas, it remains the second lowest performing industry, with an average score of 43 points out of 100. None of the top 10 performers in the report were from this sector. Companies in this sector are primarily involved in the production, sourcing, and processing of cereal grains such as corn, wheat, and soy, as well as a wide range of water-intensive fruits, nuts, and vegetables.

Only a selection of indicators are represented. See the scoring guidance here.

Areas of Strength

Targets

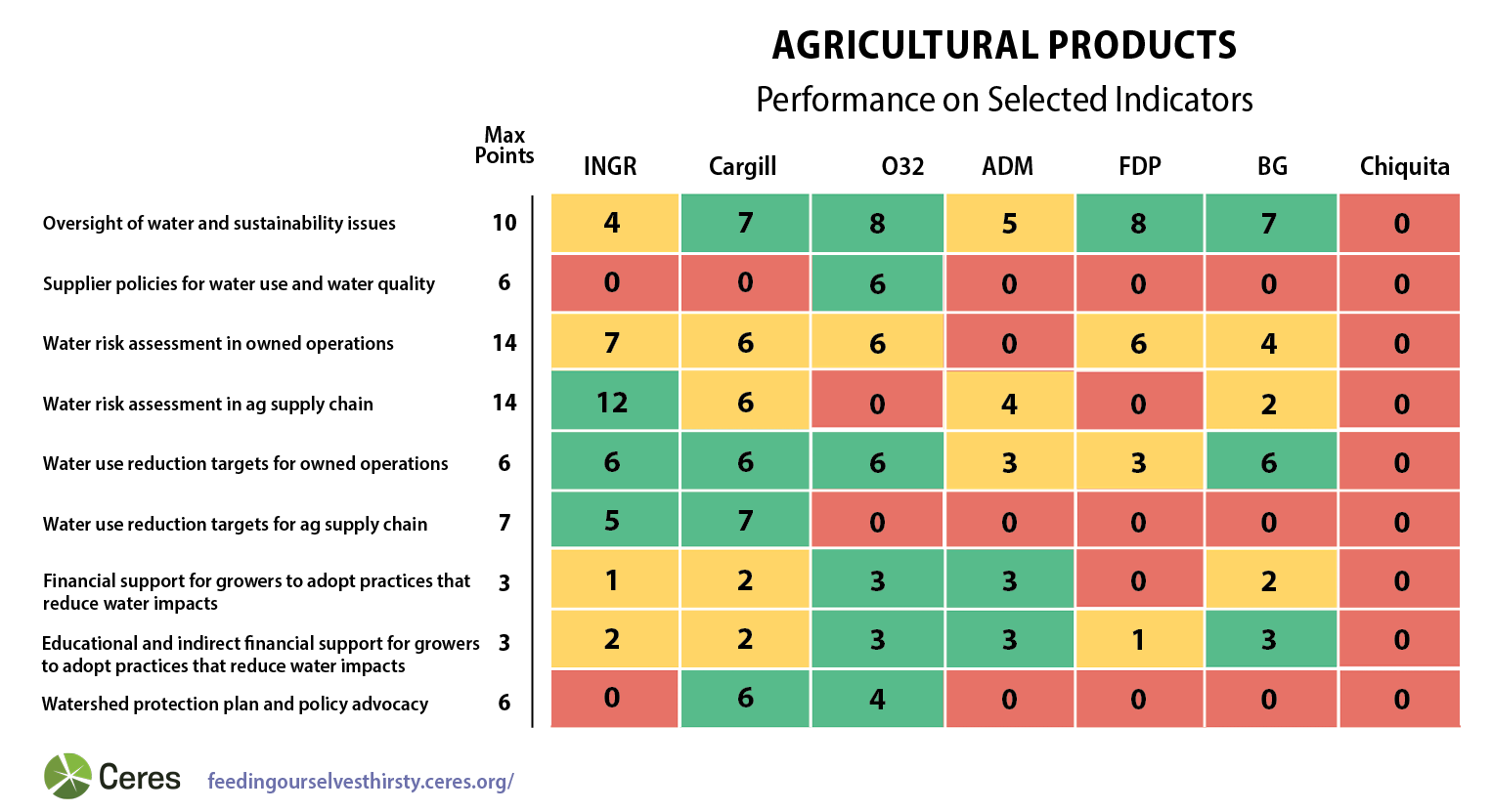

The Agricultural Products sector was the second strongest industry performer in the targets category. Nearly all of the companies have water use targets for their direct operations and four of the seven have set more aggressive targets for high risk regions. Only a small number of companies, however, have set water discharge targets for their own operations or water use targets for their agricultural supply chains.

Ingredion stood out as the strongest performer due to its 2021 AgWater Challenge commitments related to the adoption of regenerative agricultural practices for priority crops grown in high risk watersheds, representing some 30% of the company's total global sourcing.

Ingredion and Cargill are the only two companies that have set water use targets for their agricultural supply chains and differentiated targets for water stressed regions. Ingredion has also set a goal to sustainably source all priority crops from tier 1 suppliers by 2025 and tier 2 suppliers by 2030.

Fresh Del Monte also had strong improvements, mainly due to new water use and sustainable sourcing targets.

Cargill, which also saw significant improvements, has adopted a context-based approach to achieving sustainable water management in all priority watersheds in its own operations and supply chains by 2030.

Financial Incentives/Educational Support

Across the sector, there were multiple initiatives to provide educational support and indirect incentives for farmers in agricultural supply chains.

Olam has demonstrated measurable progress in its implementation efforts over the past couple years, with reportedly more than 750,000 smallholder farmers now part of its sustainability programs, an increase of 40% over the last two years. The programs now cover 3.5 million acres. Educational programs include water stewardship planning and irrigation management training for the dry season, and outreach to producers in high risk watersheds.

Areas for Improvement

Governance

Compared to the Beverage and Packaged Foods industries, the Agricultural Products industry illustrated a weaker performance along governance sub-indicators. While board oversight of sustainability issues has been implemented by all companies except for Chiquita Brands and Cargill, there is room for improvement.

Olam and Cargill are the only two companies where the individual with the highest level of direct responsibility over water-related issues reports directly to the CEO. For Olam, this has been a consistent practice since 2017.

Only two companies, Fresh Del Monte and Archer Daniels Midland, have linked their water strategy to executive compensation, with both companies offering incentives to executives for their performance against water-related KPIs.

Risk Assessment

Agricultural Products companies had a generally weak performance on risk assessment sub-indicators, andit was the second lowest scoring industry after Meat. The same weak results on risk assessments were seen for agricultural supply chains, with no companies reporting the percentage of commodities sourced from high risk regions and only a few companies including water quality in their supply chain risk assessments.

Only one company, Ingredion, disclosed the percentage and volume of total water withdrawals from regions with high water stress.

Cargill and Ingredion were the only two companies that performed a risk assessment, including for both water availability and quality, in agricultural supply chains and that disclosed watersheds with high water stress.

Supplier Policies

A supplier policy that outlines expectations regarding water quality and water use beyond regulatory compliance is an important threshold indicator for the industry. Olam was the only company that disclosed a supplier code of conduct outlining conservation and water protection expectations for suppliers.

Collective Watershed Action

Watershed protection plans and strategies for protecting key watersheds identified as high risk, along with consistent public policy advocacy to protect such resources, are important barometers of a company’s overall water management performance. Many of the companies have not taken part in collaborative efforts aimed at improving the conditions of watersheds identified in high risk regions.

Cargill and Olam are the only two companies that have demonstrated robust, watershed protection plans in high risk regions where their agricultural supply chains operate. For both, their collective action efforts involve key local stakeholders and can be found in more than one location.

Only one company, Cargill, has displayed evidence of regular policy advocacy on the topic of water, in addition to its robust collective action work.

Scoring Guidance for Selected Indicators

| Oversight of water and sustainability issues (Total possible score = 10 points) | |

| 2 points |

Board or board committee has oversight over sustainability ( +1 point) OR Board or board committee has explicit oversight over water-related issues (+ 2 points) |

| 3 point | Board or board committee is regularly briefed by management on water related issues |

| 4 points |

The individual with the highest level of direct responsibility for water-related issues reports directly to a member of the Executive Management Committee (+ 3 points) OR The individual with the highest level of direct responsibility for water-related issues reports to the CEO (+ 4 points) |

| 1 points | Water is linked to pay or incentive compensation for senior executives implicitly or explicitly |

| Supplier policies for water use and water quality (Total possible score = 6 points) | |

| 3 points | Has a publicly available supplier policy outlining expectations for Tier 1 suppliers regarding water use and water quality that exceed regulatory compliance |

| 1 points | The policy has a clear requirement for agricultural suppliers to have a water use plan in high risk regions |

| 1 points | The policy has clear requirements for agricultural suppliers regarding water quality that exceed regulatory compliance in high risk regions |

| 1 points | The policy clearly defines protocols for non-compliance |

| Water risk assessment in owned operations (Total possible score = 14 points) | |

| 3 points | Discloses the percentage and volume of total water withdrawal from regions with high baseline water stress |

| 3 points | Discloses the percentage and volume of total water consumed from regions with high baseline water stress |

| 4 points | Analysis explicitly included risks associated with water quality |

| 4 points |

Analysis explicitly discloses high risk watersheds based on water quality (+ 2 points) AND/OR based on water availability (+ 2 points) |

| Water risk assessment in ag supply chain (Total possible score = 14 points) | |

| 6 points | Discloses the percentage of agricultural products sourced from regions with high baseline water stress |

| 4 points | Analysis explicitly included risks associated with water quality |

| 4 points |

Analysis explicitly discloses high risk watersheds based on water quality (+ 2 points) AND/OR based on water availability (+ 2 points) |

| Water use reduction targets for owned operations (Total possible score = 6 points) | |

| 3 points | Has time-bound water use reduction targets for direct operations |

| 3 points | Uses a risk-differentiated, context-based, or science-based approach, focusing on watersheds with high water stress |

| 3 points | Has targets to reduce water pollution impacts of its operational discharge, focusing on pollutants of concern |

| Water use reduction targets for ag supply chain (Total possible score = 7 points) | |

| 4 points | Has time-bound water use reduction targets for agricultural regions/commodities |

| 3 points | Uses a risk-differentiated, context-based approach, focusing on watersheds with high water stress |

| Financial support for growers to adopt practices that reduce water impacts (Total possible score = 3 points) | |

| 2 points | Provides financial incentives to producers to encourage adoption of practices that reduce impacts and dependence on water |

| 1 points | Identified in high-risk watershed specifically |

| Educational and indirect financial support for growers to adopt practices that reduce water impacts (Total possible score = 3 points) | |

| 2 points | Provides education or indirect financial incentives to producers to encourage adoption of practices that reduce impacts and dependence on water |

| 1 points | Identified in high-risk watershed specifically |

| Watershed protection plan and policy advocacy (Total possible score = 6 points) | |

| 4 points | Has developed a watershed protection plan or strategy for key watersheds identified as high risk in their agricultural supply chain which includes plans to support projects that improve conditions for the watershed in collaboration with key local stakeholders |

| 2 points | Consistently advocates for public policy action to protect water resources in company's priority watersheds |

Scores are based on companies' public disclosures as of June 15, 2021.