Introduction

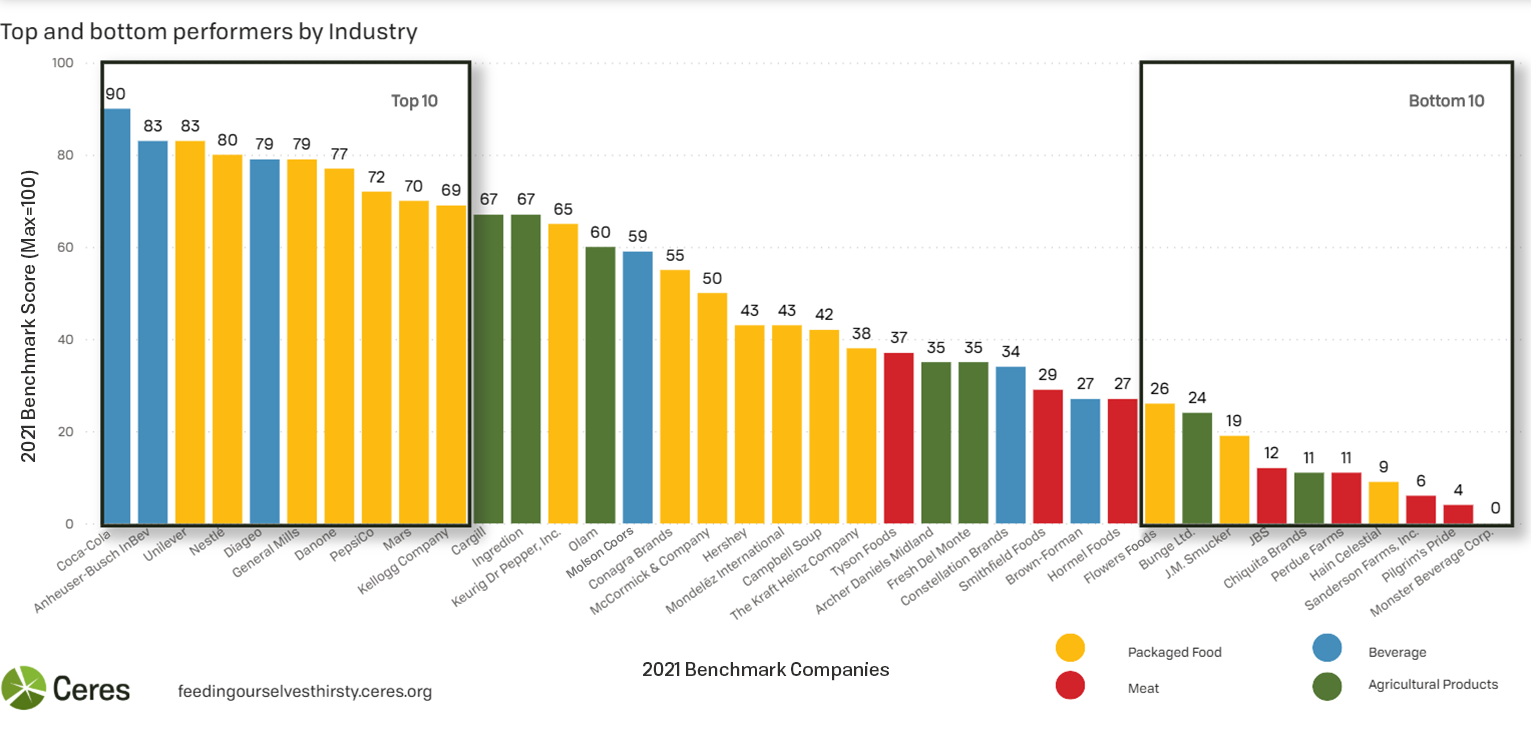

In this analysis, Ceres looks at how food sector companies are responding to water risks and how their performance has changed in key areas since our first round of benchmarking in 2015. Ceres evaluated 38 food companies in four industries with the highest exposure to water risks: Agricultural Products, Beverages, Meat, and Packaged Foods. This group includes some of the largest U.S.-based and publicly traded companies, as well as a small number of large private and non-U.S. companies. Companies were assessed, based on public disclosures by the companies up to June 15, 2021, on a 0-100 points basis across four categories of water management: Governance (22 points), Risk Assessment (28 points), Targets (36 points), and Implementation (14 points).

For readers who are less familiar with these concepts, here’s a quick primer:

- Key aspects of governance are corporate board oversight, senior executive oversight, business planning and supplier policies.

- Risk assessments include analysis and disclosure on water risks for owned operations and agricultural supply chains in high risk watersheds.

- Water targets are publicly disclosed, time-bound, quantifiable water use reduction goals for owned operations and key agricultural supply chains, as well as sustainable agriculture commitments with clear water protection outcomes.

- Implementation includes educational and direct/indirect financial support for growers and collaborative actions to protect key high risk watersheds.

This year’s report methodology has been modified and streamlined, leading to changes in scoring. The changes were made to ensure that the scores reflect the most relevant aspects of companies’ water risk management and align with global standards that investors rely on, such as SASB and CDP.

Of particular note, we increased the scoring weight and enhanced the indicators applied to agricultural supply chains, which contain the bulk of the food sector’s exposure to water risks. This resulted in prioritizing and adding indicators around time-bound quantifiable goals for reduced water use in supply chains and linking business activities to address threats in high risk watersheds. Because of these adjustments, we de-prioritized several indicators related to direct operations and manufacturing supply chains.

The 2021 report provides details on total scores, based on the updated methodology. In addition, this report includes general sectoral trends and trends across analogous indicators over time, in areas of water risks and corporate governance, water risk assessments, water use reduction targets, sustainable sourcing commitments, grower support and sustainable production incentives, and collective action at the watershed level.

Learn more about the report methodology, including categories and indicators used to evaluate company performance and point allocations.

Performance Trends

Overall Performance

The food sector showed steady improvements in water stewardship based on our latest methodology and analogous indicators used in all four reports. The companies provided evidence of programs and goals to increase water quality and efficiency in their own operations and promote water quality and water-saving practices in their supply chains, including those in water-stressed regions.

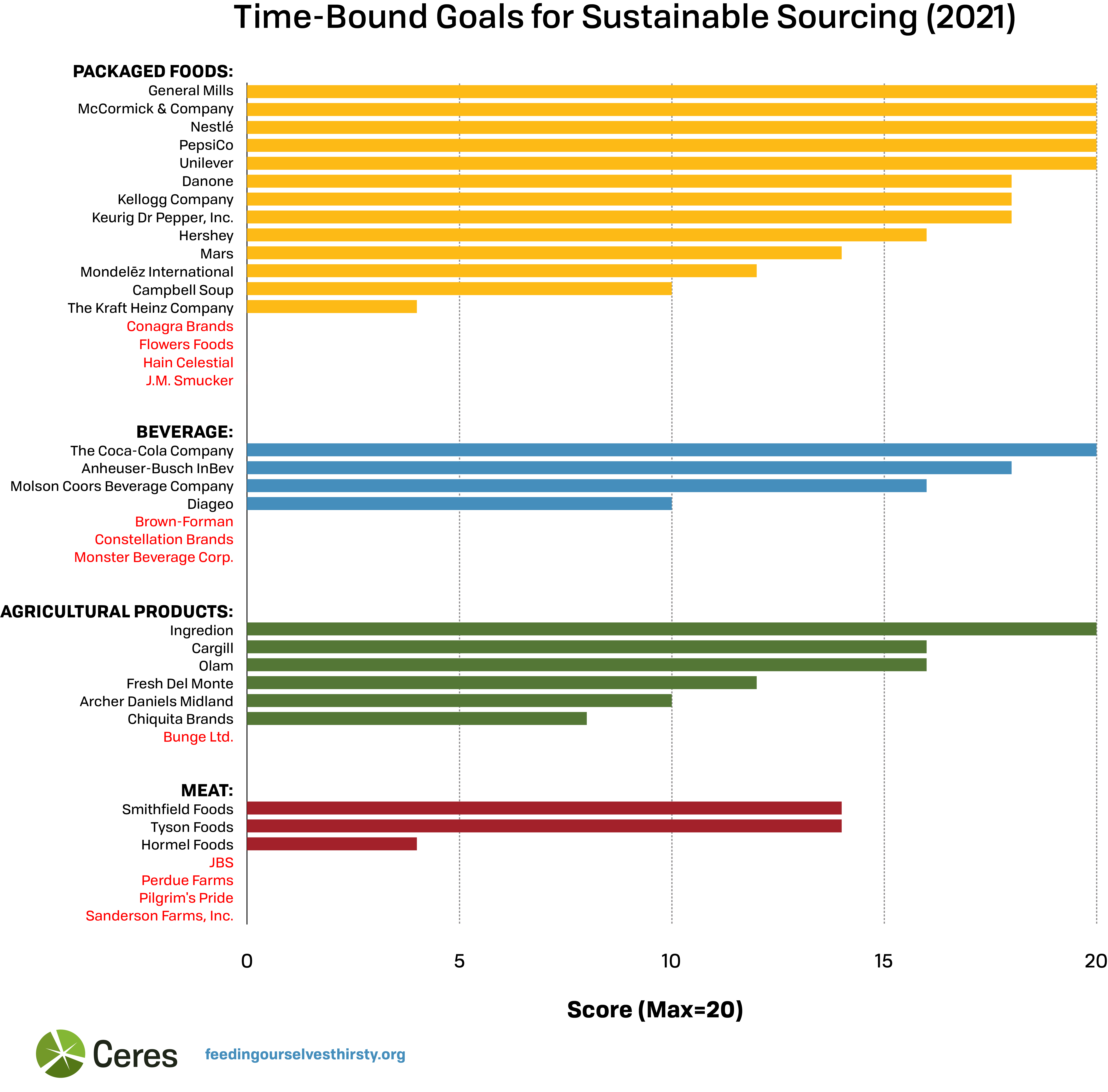

The average overall score in this year’s report was 45 points. Consistent with our previous reports, the highest scores were in the Packaged Food and Beverage sectors, followed by the Agricultural Products and Meat sectors, the latter being the weakest by far, similar to past years’ performances.

Among the key improvement trends:

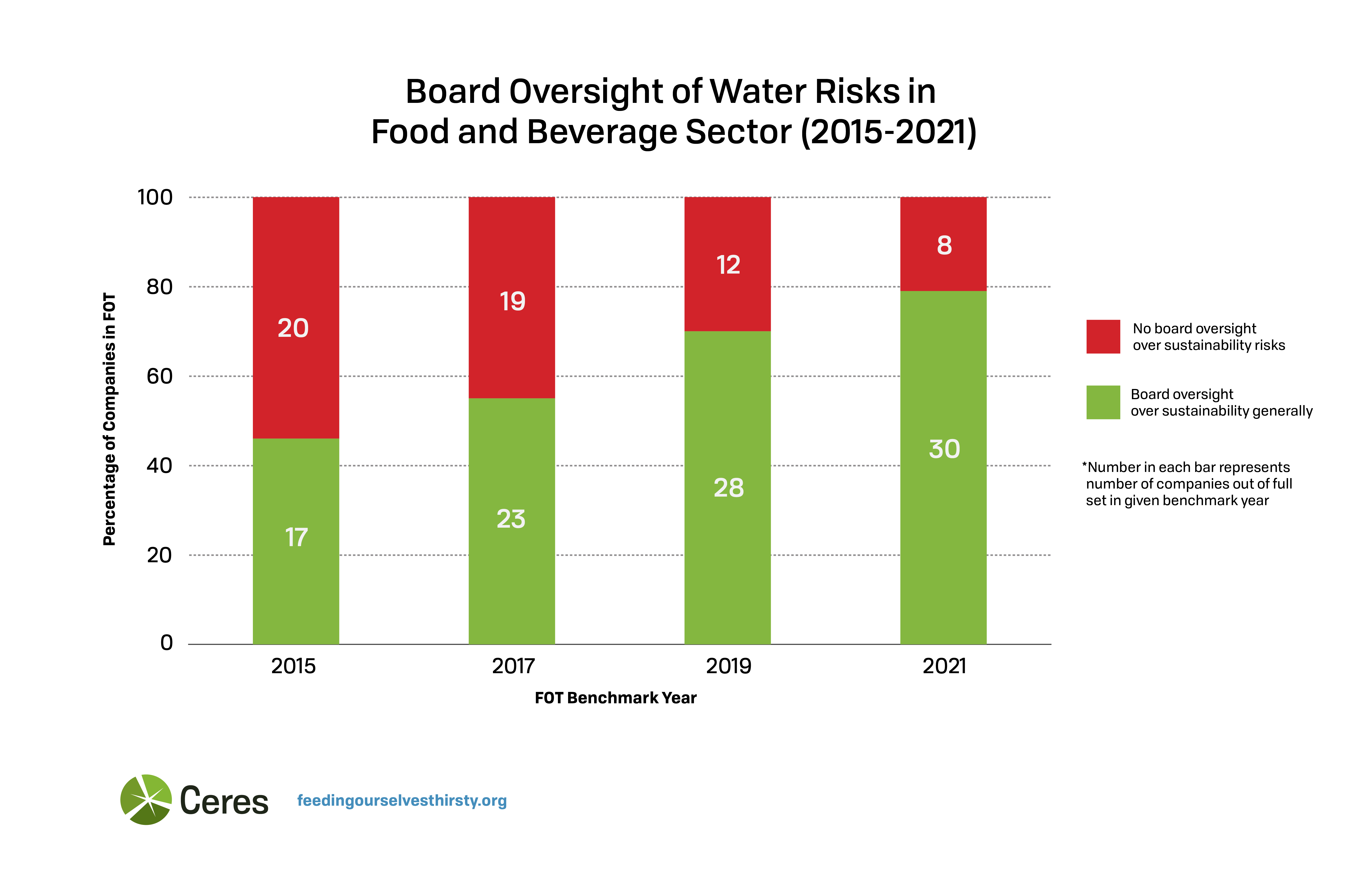

- 79% of the companies’ boards have explicit oversight over sustainability-related issues, a 44% jump from 2017.

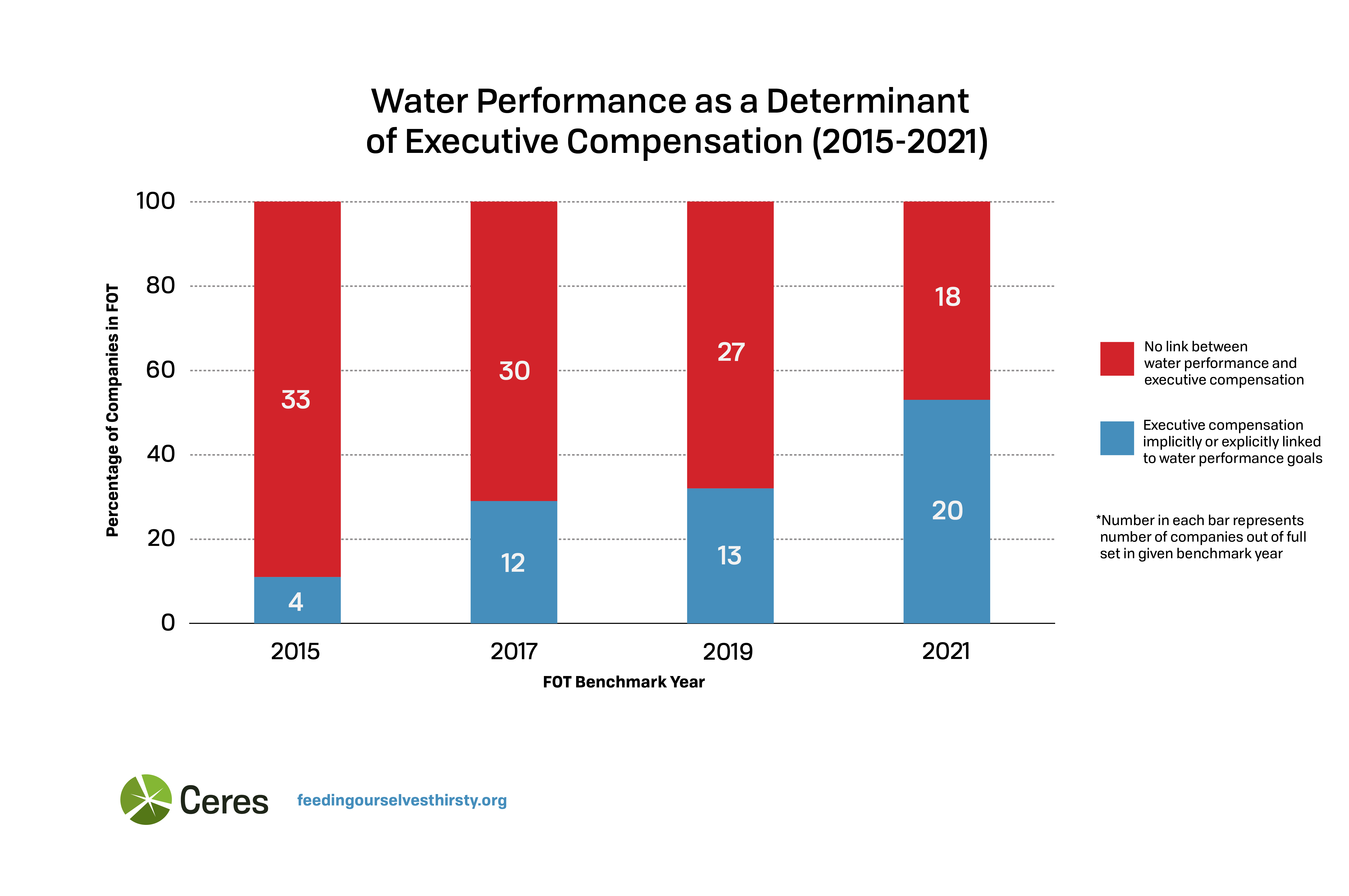

- 53% of the companies link executive compensation to water performance goals, a 60% jump from 2019.

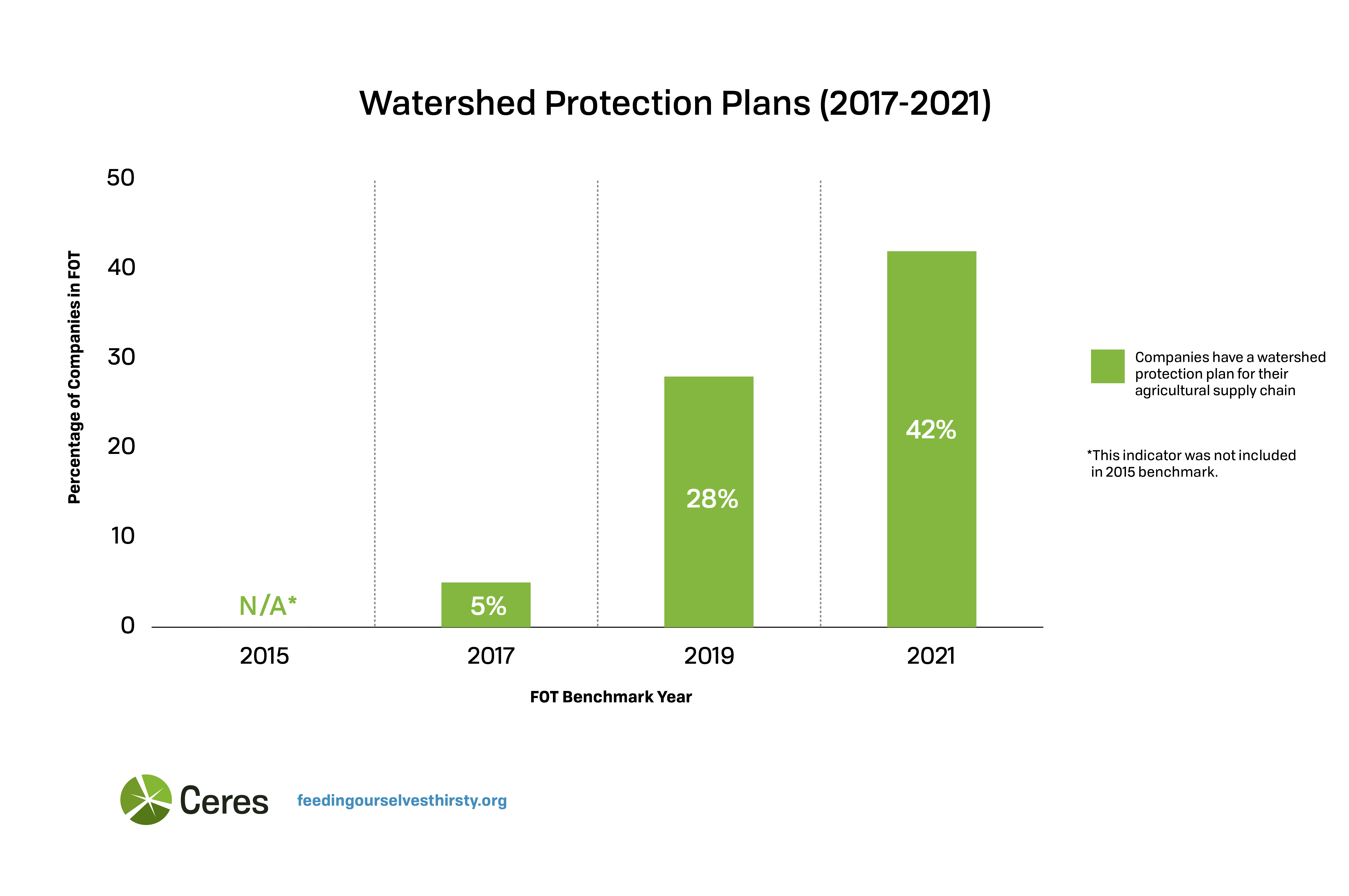

- 42% of the companies have a watershed protection plan for their agricultural supply chain, a 50% increase from 2019.

- 55% of the companies provide financial incentives to farmers to encourage adoption of practices to reduce water use and impacts, a 60% increase from 2019.

Among the areas where progress is still limited:

- Only a small number of companies - 17 - disclosed a supplier policy that includes specific expectations regarding water use and quality, while even fewer - eight - demonstrated policies that define protocols for non-compliance.

- Less than half of the companies - 18 - performed robust water risk assessments (inclusive of water quality) that focus on their agricultural supply chains.

- Only a handful of companies - nine - have implemented water use reduction targets for key growing regions in their supply chains.

- A mere 12 companies focused their direct or indirect financial support on farmers growing key ingredients in high-stress water basins.

Strong and Weak Company Performers

Coca-Cola earned the top score overall, with 90 points, based on the company’s new 2030 water security strategy, which includes targets to achieve 100% “regenerative water use” in water stressed areas by reducing, recycling, and reusing local water supplies, deeper engagement with agricultural suppliers, and collaborative efforts to develop watershed protections plans in regions of China, India, Kenya, and the U.S. Midwest.

Other top scorers were Anheuser-Busch InBev, with 83 points, based on strengthening of its supplier policies on water and sustainable sourcing targets, and Cargill, which showed substantive improvements, thanks to a stronger system for senior management oversight and new context-based and science-based targets developed with guidance from World Resources Institute (WRI).

In sharp contrast, JBS was at the lower end of the companies scoring poorly in assessing water risks in their supply chains and setting new water efficiency targets.

At the bottom of the barrel, Monster Beverage was the weakest performer by far, with 0 points. The company still hasn’t implemented a comprehensive water management strategy for its own operations and supply chains.

Average Industry Scores

The Packaged Food and Beverage sectors had the highest average scores, with 54 points and 53 points, respectively. Both saw solid progress due to broad improvements in their supplier policies and sustainable sourcing goals, many of them focused on water stressed regions. All of the top 10 performers in the report were from the Packaged Food and Beverage sectors.

The Agricultural Products sector remained in the bottom third, consistent with previous years, with an average score of 43. While Cargill and Ingredion posted impressive improvements, due largely to more ambitious water targets, two companies in the sector, Bunge Ltd. and Chiquita Brands, were bottom 10 performers.

The Meat sector continues to be an especially weak performer, with an average score of 18 points. Four of the seven meat companies analyzed in the report – JBS, Perdue Farms, Sanderson Farms and Pilgrim’s Pride – were bottom 10 performers. Tyson Foods had the highest score, with 37 points. Of particular note, none of the Meat companies had a water reduction goal in their agricultural supply chains.

Water Risks and Corporate Governance

Water scarcity and water pollution pose financially material physical, regulatory, and reputational risks to the global food sector. Climate change is a “threat multiplier” to these risks. Strong board-level and senior executive oversight on water risks are key building blocks, along with robust supplier policies and executive compensation packages that are closely linked to sustainability metrics, including water-related targets.

Boards can take the following steps to demonstrate to investors that their oversight over water-related risks is more than a formality:

- Strengthen board committee charters by explicitly formalizing oversight over water-related issues.

- Implement more frequent board briefings by management on water-related risks, and take more opportunities to engage with external water experts.

- Strengthen disclosure on how water-related risks are considered in major strategic decisions and capital allocations.

- Strengthen linkages between executive compensation plans and performance on sustainability metrics, including water-related targets.

Importantly, 79% of the companies analyzed have demonstrated formal board oversight of sustainability issues, up from 46% in 2015. However, far fewer boards are briefed on water issues (66%), with the Packaged Foods sector accounting for the majority of those that are. Importantly, we continue to observe that no company boards have explicitly formalized oversight over water-related issues through a committee charter.

Anheuser-Busch InBev showed major progress in governance, due to the release of new supplier policies that have clear expectations for growers regarding water use and quality, including water use in high-stress basins.

More than half of the companies analyzed – 53% – linked executive compensation implicitly or explicitly to water performance goals, up from just 11% in 2015.

Diageo’s board of directors has direct oversight over water-related issues. The company has also developed a “true cost of water” tool to assess direct and indirect costs of water use to help inform future strategies.

Fresh Del Monte and Archer Daniels Midland are the only two companies in Agricultural Products that link their water strategy to executive compensation. Both companies offer executive incentives for their performance against water-related KPIs.

Ten companies in Packaged Foods have implemented executive incentive systems that consider performance indicators related to water, with Kellogg’s, Mondelez, and McCormick all improving their performance in this area since 2019.

Water Risk Assessments

Abundant clean water is essential for food production – as an ingredient, for cleaning and growing raw materials, and as the principal agent in sanitizing plant machinery. However, the vast majority of the food sector’s water use and water pollution footprint is associated with agricultural supply chains. Water risks from these supply chains include agricultural runoff, impaired ecosystems, regulatory risks, and limited local access to water. While more companies are assessing water risks in their agricultural supply chains, the scope and rigor of these assessments is often limited.

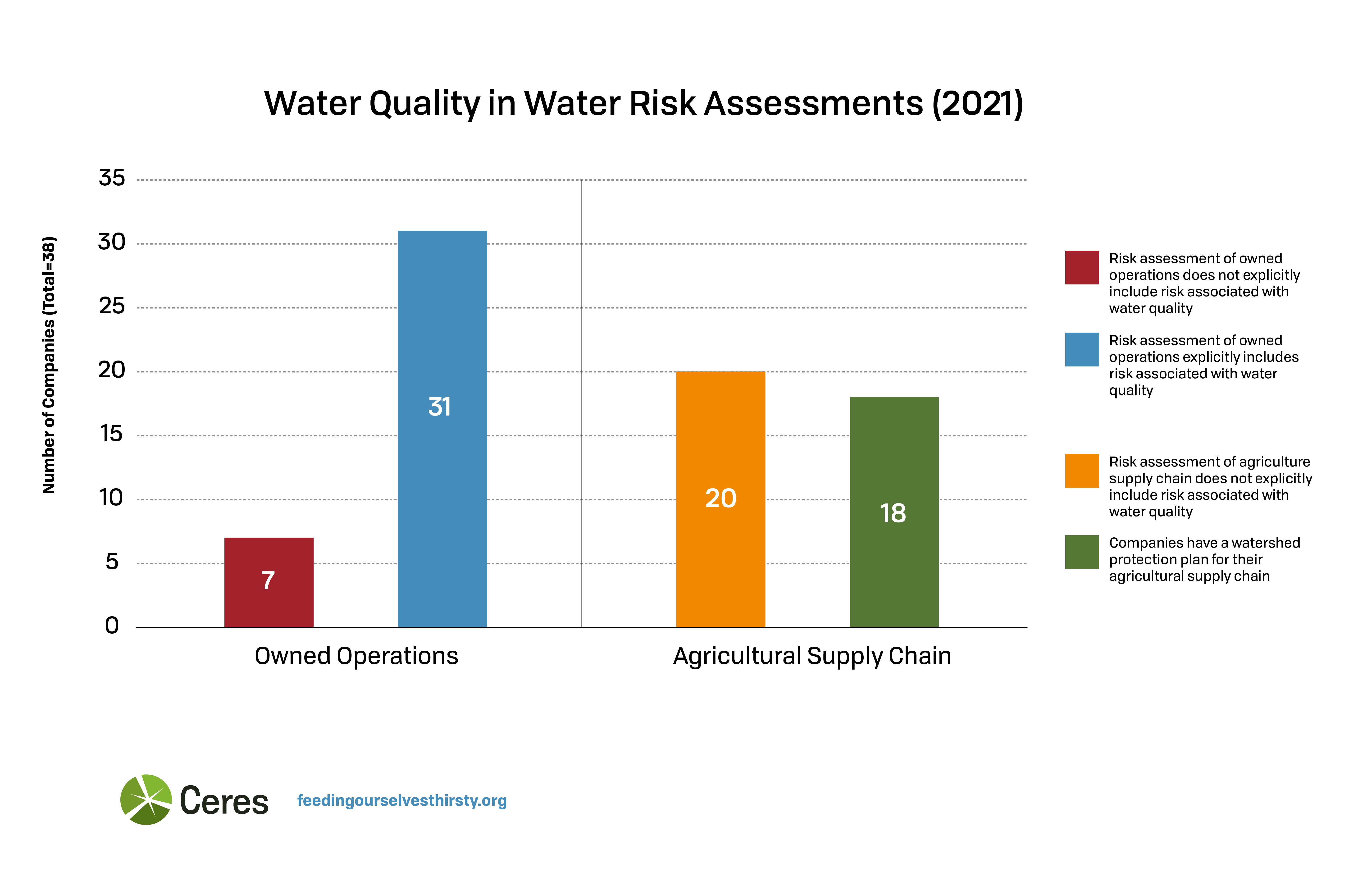

Of the 38 companies analyzed, 31 performed water risk assessments of owned operations that explicitly include risks associated with water quality.

Less than half of the 38 companies – 18 – did comparable water risk assessments focused on their agricultural supply chains. While this is an increase from 2019, when only one-third of companies had analyzed this exposure, there is still much room for improvement.

While most Packaged Food and Beverage companies have performed a water risk assessment for their own operations, including water quality, very few have performed such assessments for their supply chains.

Conagra was a top performer on this indicator in Packaged Food, because it includes risks associated with water quality in its analysis, and it explicitly discloses high-risk watersheds in their supply chain.

Anheuser-Busch InBev was the only Beverage company that disclosed any locations of its supply chain footprint in high risk watersheds, in addition to its operational footprint in high risk areas.

In the Agricultural Products sector, Cargill and Ingredion were the only companies that performed agricultural supply chain risk assessments, including of both water quality and availability, and Ingredion was the only one that reported the percentage of its agricultural supply products sourced from regions with high baseline water stress.

Only one Meat company, Hormel Foods, has implemented a risk assessment process, including for water quality, for its top suppliers. No Meat company has disclosed the location of high risk water regions based on water quality and water availability.

Water Use Reduction Targets

While robust governance and risk assessment systems are foundational to analyzing and managing corporate water risks, time-bound, quantifiable water use reduction goals are an important strategy for managing a company’s water risks. Reduced water use in direct operations are hugely important, but strategically targeted reductions across a company’s vast supply chain, especially those in water stressed regions, are even more so.

This is because business assets located in conditions of high or medium water stress are exposed to greater risk of losing reliable water inputs to their operations. Reflective of these risks, companies should be establishing water efficiency targets across their value chains. Activities dependent on water resources from high risk basins should have more stringent water savings goals.

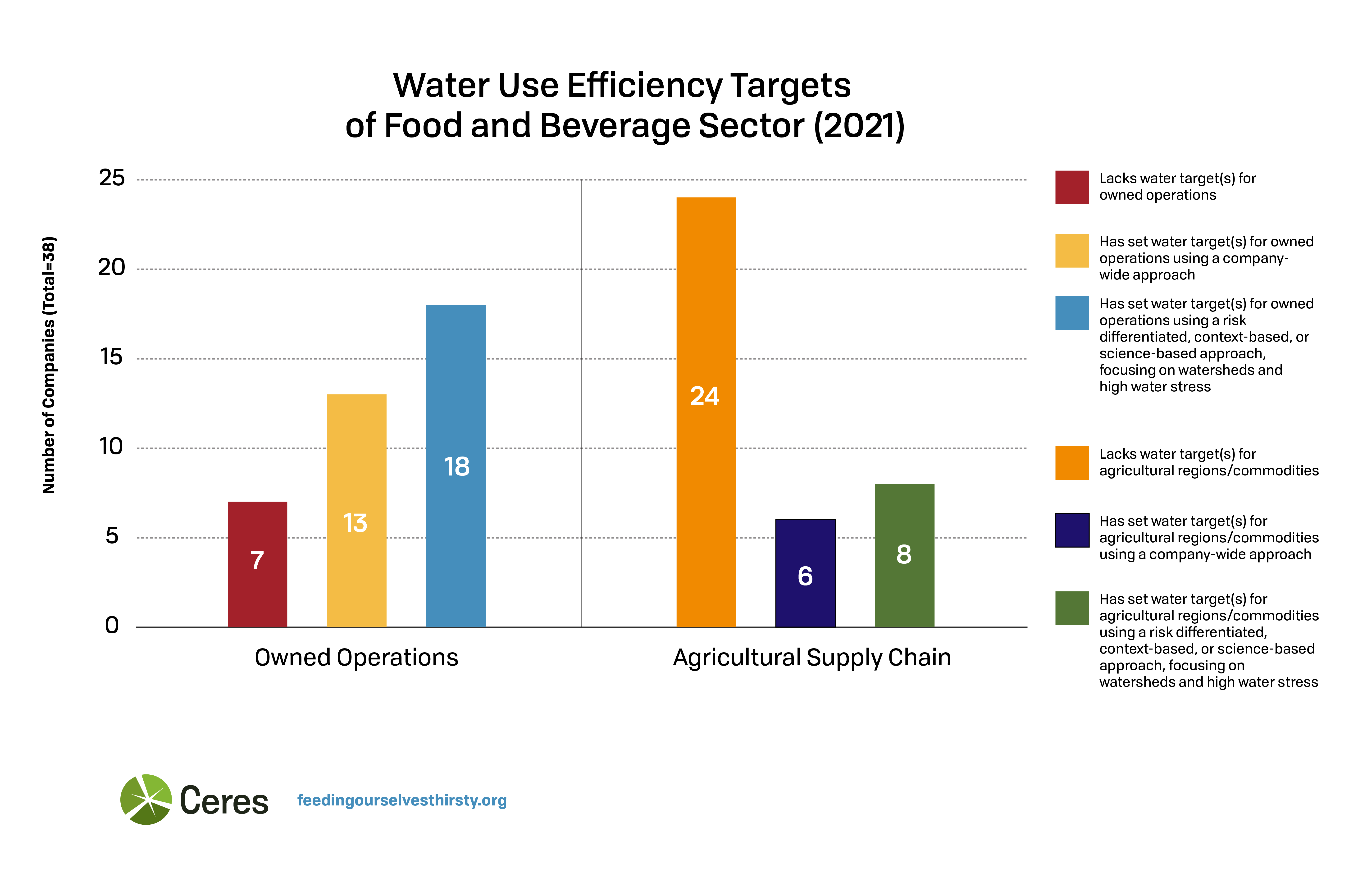

Of the 38 companies analyzed, 82% had water reduction targets to reduce water use in their direct operations, but only 37% had time-bound water efficiency targets for sourcing regions in their supply chains. Only three Meat companies disclosed water use targets for their own operations, and none had water targets focused on their supply chains.

This year, 18 of the benchmarked companies - 47% - had developed additional, more ambitious water targets for operations they own in regions with high or medium water risks. This was up from only 25% of companies in 2019. Nearly 80% of all companies, however, failed to set more aggressive water use targets for portions of their agricultural supply chains located in high or medium risk watersheds.

Poor water quality also presents a significant risk exposure for businesses. While 31 companies included water quality in their operational risk assessments, only seven had established targets for reducing water pollution impacts from their operational discharges.

While most Agricultural Product companies had not developed targets to reduce water use in agricultural regions or for priority commodities, Cargill was a leading performer in setting new context-based and science-based targets, including for its operations and its supply chain, that prioritize stewardship efforts in each of its priority watersheds. Cargill plans to restore about 158 billion gallons of water and reduce about 5,500 tons of water pollutants by 2030 – all in 25 priority watersheds where the company has an extensive supply chain.

Packaged Foods had the strongest performance in setting targets for their agricultural supply chains, with more than half implementing targets for sourcing regions. Focusing on key supply chain commodities such as corn and potatoes, PepsiCo set a goal to improve water use efficiency by 15% in high water risk areas by 2025.

Ingredion performed well due to its new ambitious water targets and sustainable agriculture commitments. The company set a target to reduce water use intensity in high-stress agricultural locations by 30% by 2030. Ingredion also set a target to cut chemical oxygen demand by 10% from operational wastewater discharges.

Sustainable Sourcing Commitments

Agricultural supply chains, which contain the bulk of the food sector’s exposure to water risks, were emphasized in the current methodology. Sustainable agriculture commitments that promote water outcomes in the “water use targets” section of the methodology receives the most weight of all sub-indicators, accounting for 20 of 36 overall points. These time-bound, quantifiable commitments should be designed to achieve measurable performance impacts on environmental and water improvements and should strategically and substantively focus on key commodities. The use of metrics-based platforms and standards to measure and disclose progress on these commitments is another important sub-indicator contemplated by the methodology.

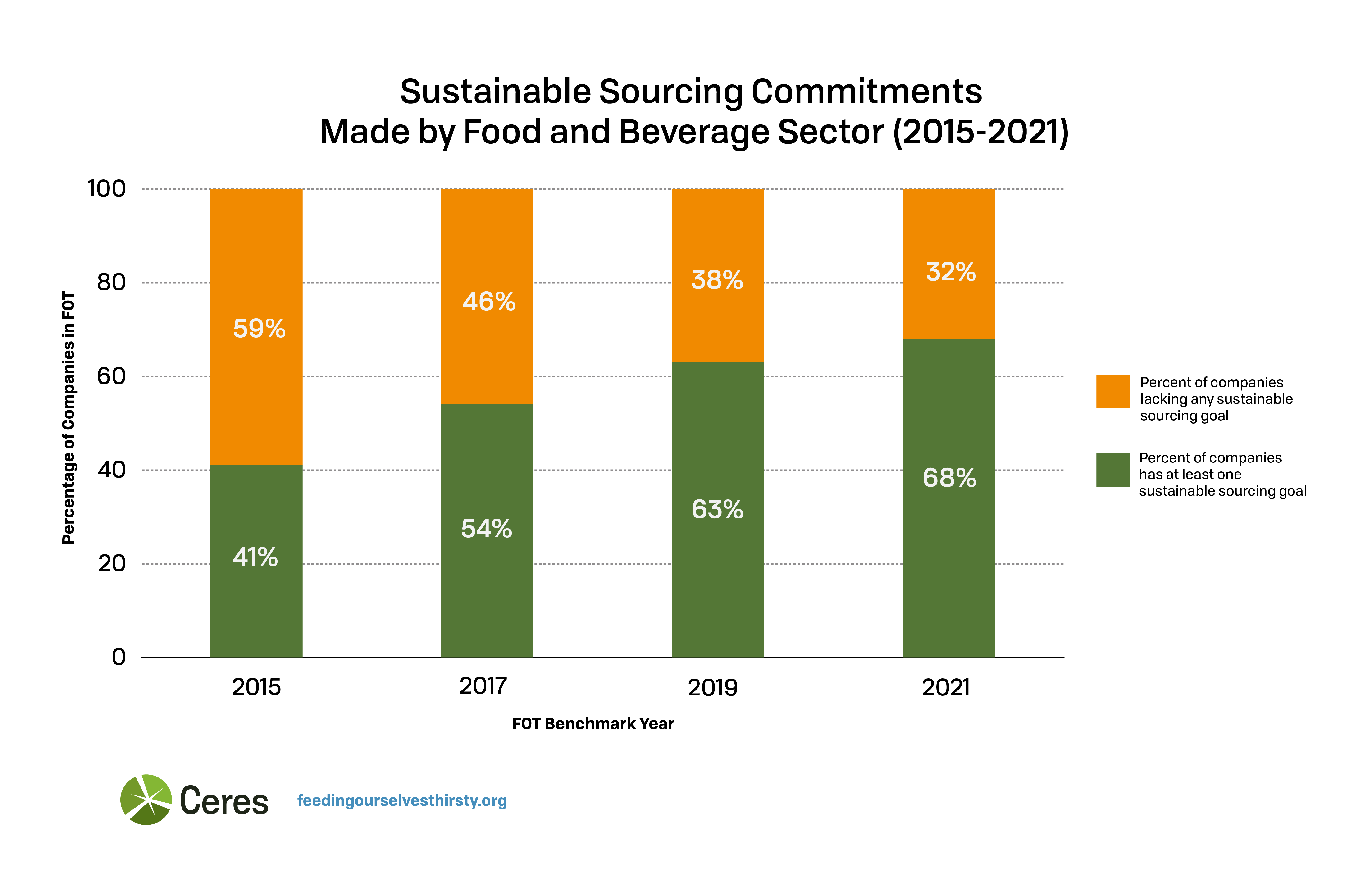

Sixty-eight percent of the food and beverage companies had at least one sustainable sourcing commitment, up from only 41% in 2015. The strongest performer was Agricultural Products, with nearly all of the companies disclosing goals aimed at sustainably sourcing their priority commodities.

While this improvement over time is encouraging, nearly one-third of the companies studied still lack such goals. As more companies set sustainable sourcing goals, the lack of common definitions, tools, and ways to measure progress makes it difficult to evaluate and compare the strength of these commitments. We used a the following five-part structure to evaluate the strength of the commitments:

A. Time-bound and quantifiable: The commitment has a publicly disclosed target achievement date and is paired with clear performance indicators that define “sustainably sourced.”

Leading example: Ingredion has disclosed a goal to sustainably source 1 million metric tons of crops by 2030 and to sustainably source all priority crops from Tier One suppliers by 2025 (and 2030 for Tiers One and Two).

B. Impact oriented: The commitment aims to measure and improve environmental and water-related performance, either directly (for example, water efficiency per acre, nitrogen reduction per ton, etc.), or indirectly (for example, adopting specific practices such as cover cropping).

Leading example: Molson Coors Beverage Company has set a target to source 100% of its agricultural brewing ingredients sustainably by 2025. The company is also taking part in a barley research effort to reduce water use per metric ton of barley grown.

C. Commodity breadth: The commitment applies to a majority of the company’s significant agricultural inputs.

Leading example: General Mills has disclosed time-bound sustainable sourcing commitments and a detailed strategy for achieving them, including a “sustainable definition” for each target. This is the only Packaged Food company that has disclosed a table with all sourcing targets and provided a definition for each of them.

D. Commodity depth: The commitment applies to a significant portion of the procurement of the commodity in question.

Leading example: Diageo has set a target for sustainable water stewardship for 100% of its owned agricultural land and all raw material suppliers by 2025.

E. Platforms and Standards: The company uses metrics-based platforms and standards to measure and disclose progress against its sustainable sourcing goals.

Leading example: PepsiCo uses the SAI Platform’s Farm Sustainability Assessment for several priority raw materials, including orange juice, bananas, beet sugar, corn syrup, and apple juice. It also uses Bonsucro for cane sugar and the Roundtable on Sustainable Palm Oil for palm oil.

Other Leading Examples

Nestlé has committed to source 50% of its key ingredients through regenerative agricultural methods, identified 15 raw materials that present a high risk of potential environmental issues, and disclosed progress along the goals set for each commodity. The company is engaged in different initiatives and platforms, including the Roundtable on Sustainable Palm Oil, Alliance for Water Stewardship, Consumer Goods Forum (CGF), One Planet Business, and Sustainable Coconut and Coconut Oil Roundtable.

Unilever has disclosed water commitments for agricultural suppliers that are paired with clear, time-bound performance indicators that define sustainable sourcing covering all of its priority commodities. Unilever has reported a commitment to engage with farmers and implement water stewardship programs at 100 locations in water stressed areas by 2030. It also launched its Regenerative Agriculture Principles in 2021, which focus on soil health, farm biodiversity, crop diversity, and climate resilience. The company employs metrics-based platforms and standards, including the Alliance for Water Stewardship, Rainforest Alliance, Round Table on Responsible Soy, Roundtable on Sustainable Palm Oil and SAI Platform, to measure and disclose progress on its sustainable sourcing goals.

Grower Support and Sustainable Production Incentives

Many recent company commitments include promoting practices to improve soil health that lead to notable improvements in ecosystem processes, including water quality. These practices have been shown to improve crop productivity, reduce erosion, increase water holding capacity, promote biodiversity, improve water quality, and, in many cases, increase soil carbon levels. However, these shifts in cultivation practices take time and resources and can pose management risks for growers.

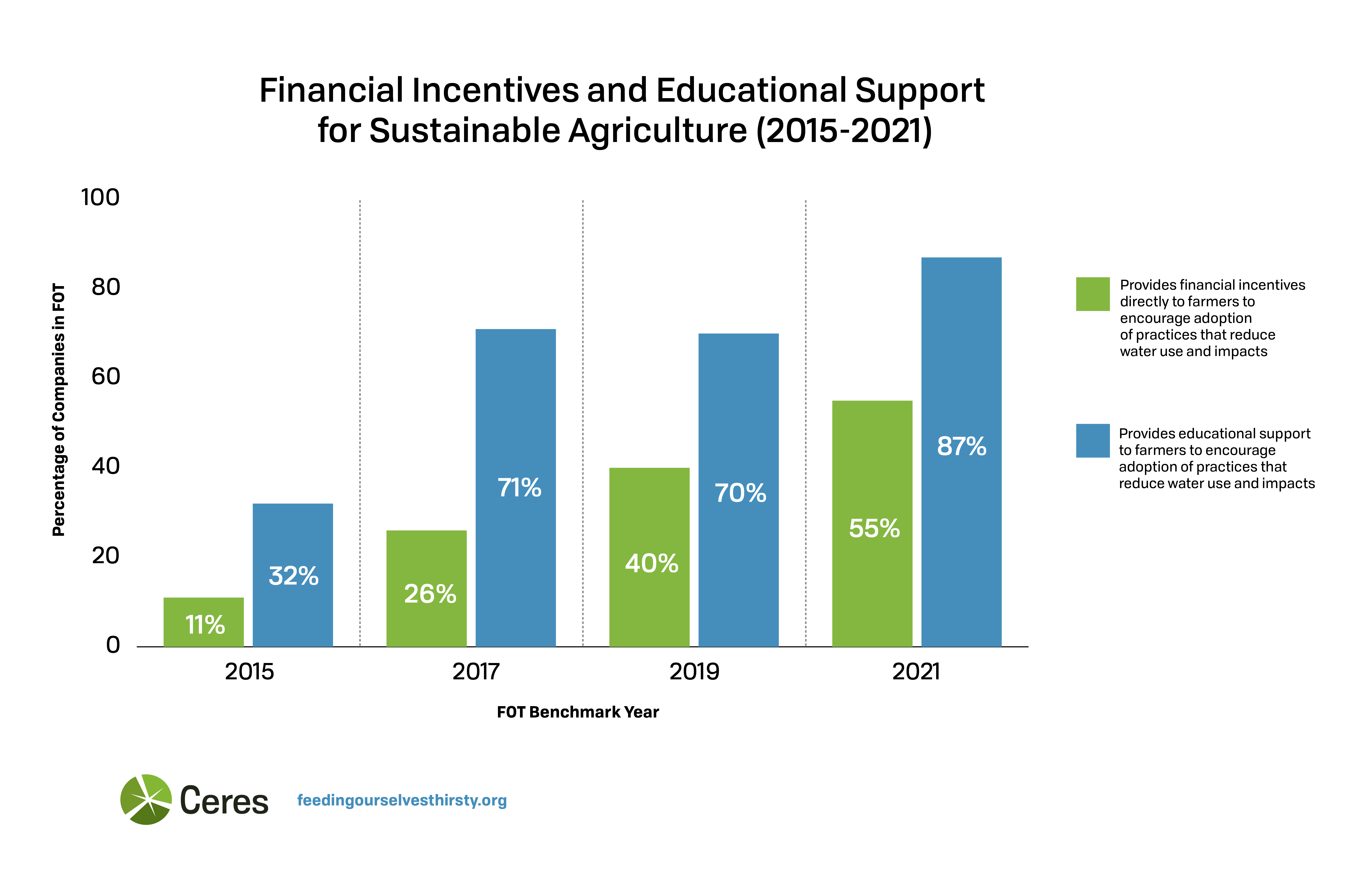

Given the vast supply chains that food sector companies rely on, providing their growers and producers with financial incentives and educational support is critical to helping achieve their sustainable sourcing goals.

Eighty-seven percent of the companies analyzed provided educational support to farmers to encourage adoption of practices to reduce water use and impacts, up from 70% in 2019 and 32% in 2015. More than half of the companies - 55% - provided direct financial incentives to farmers to encourage such practices, up from 40% in 2019 and 11% in 2015.

The Packaged Food sector had the strongest performance, with more than half of the companies providing direct financial incentives to their producers, seven of which were providing direct incentives to more than half of their suppliers. Danone provided funding to farmers for regenerative agriculture practices targeted at commodities with the highest water risk exposure.

Cargill received high marks for offering a premium to farmers for practices, such as cover crops and soil health programs, aimed at improving water quality. Cargill, PepsiCo, and Ingredion partnered with the Soil and Water Outcome Fund (SWOF), which compensates farmers on over 100,000 acres of cropland for implementing practices that enhance water quality and carbon sequestration.

Molson Coors Beverage Company has developed an incentive program that applies to 95% of its barley growers and supports suppliers transitioning to sustainable agriculture practices.

Anheuser Busch InBev and Coca-Cola were the only Beverage companies that have implemented programs in high risk watersheds to train suppliers on sustainable agriculture practices.

Mars has committed to deploying farmer training and technology for sustainable water use, including nutrient and chemical management, on 11,000 rice hectares in the U.S. by 2025. Mars plans to support this through partnerships with civil society and agronomists, incentives for suppliers and farmers, and co-funding for water efficiency programs.

Only two Meat companies, Smithfield Foods and Tyson Foods, have training and incentive programs for growers that align with their sustainable sourcing goals. Smithfield Foods, for example, engages with more that 75% of its grain producers to provide training on practices that contribute to reduced water usage and improved yields.

Collective Action at the Watershed Level

Collective watershed protection projects, undertaken with relevant stakeholders, are important strategies to improve governance, address local water supply challenges, and promote the adoption of best practices that reduce water use and increase replenishment. Watershed protection plans and strategies for protecting key watersheds identified as high risk, along with consistent public policy advocacy to protect such resources, are important barometers of a company’s overall water risk performance.

Forty-two percent of the companies analyzed developed a watershed protection plan or strategy for protecting key watersheds identified as high risk in their agricultural supply chain, up from just 5% in 2017.

The strongest sector performer was Packaged Foods, with more than half of the companies engaged in collaborative actions to improve conditions of water stressed regions. Most of the companies have also been part of advocacy initiatives at least twice a year that target the advancement of public policy and regulation on water management issues.

Cargill has partnered with The Nature Conservancy and has developed projects related to watershed protection in the Mississippi River Basin and the Ogallala Aquifer. Olam has engaged with nonprofit groups and local authorities to implement water stewardship initiatives in areas like the Chambeshi Basin in Zambia.

Three Beverage companies – Anheuser Busch InBev, Diageo and Coca-Cola – receive top marks for engaging in public policy action aimed at protecting water resources.

Nearly all of the Beverage companies have taken part in collaborative efforts to protect high risk watersheds, the exceptions being Brown-Forman and Monster Beverage. Coca-Cola has been engaged in multi-stakeholder collaborative efforts to develop watershed protection plans in countries such as India, China, Uruguay, and Kenya.